do pastors file taxes

Pastors may voluntarily choose to ask their. Answered as a US tax specialist and the spouse of a man who worked exclusively as a Presbyterian pastor for 13 years.

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

FICASECA Payroll Taxes.

. They must pay social security. Yes pastors pay federal income tax. Thus its suggested the church provide a social security.

Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks. Monday February 21 2022 Video QA. When filing their taxes they would use Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship to report their.

The IRS does not exempt pastors from paying taxes on their income just because they are a pastor. Answer Simple Questions About Your Life And We Do The Rest. Answer 1 of 3.

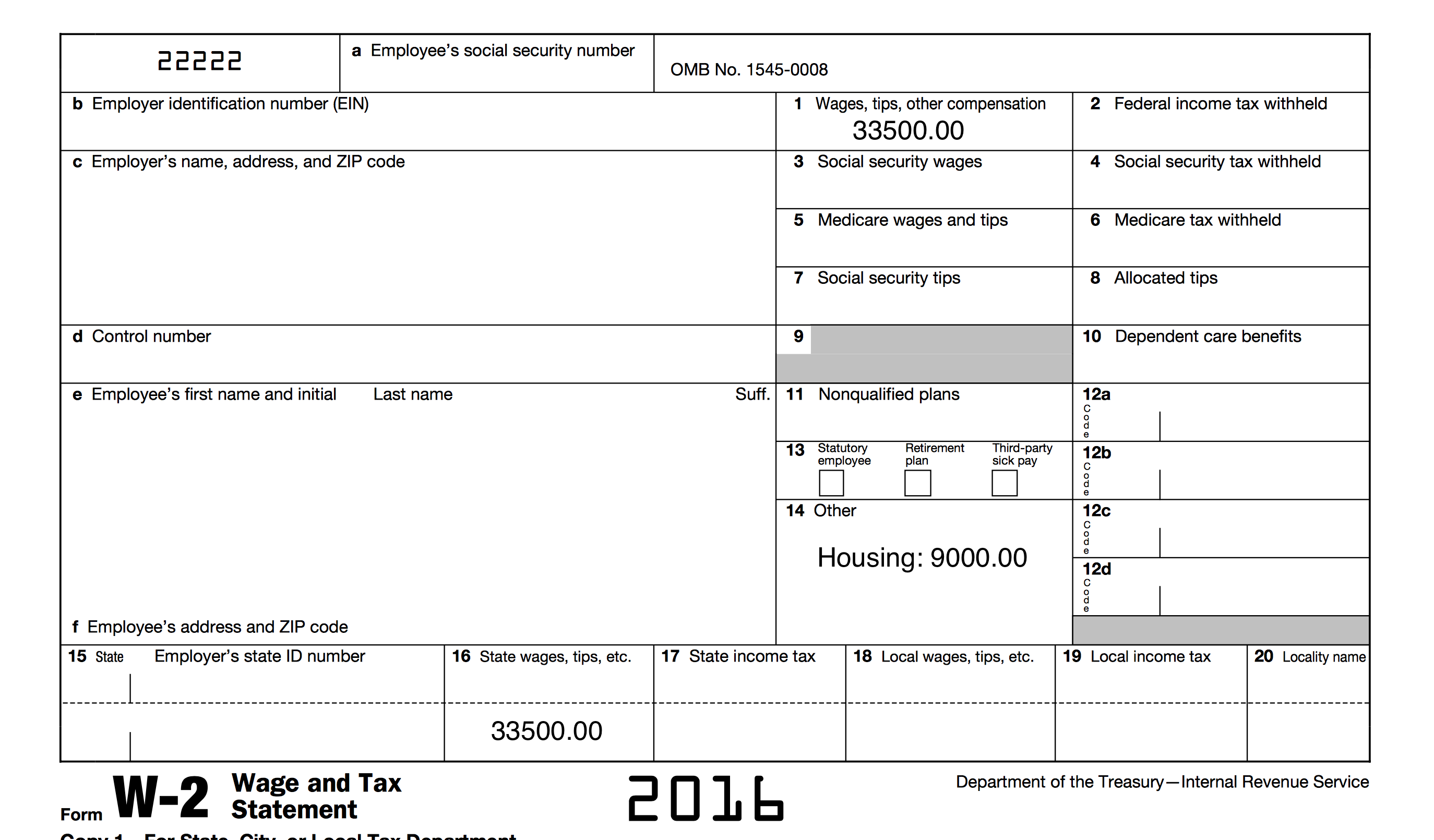

This means congregation members may be less tempted to. For income taxes purposes you can be considered a common-law employee or self-employed. Employees earn wages that are reported on Form W.

Simplify Tax Filing W TurboTax. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or. Churches do enjoy tax-exempt status with the Internal Revenue Service.

June 7 2019 303 PM. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. However certain income of a church or religious organization may be subject to.

The popular notion that pastors do not pay taxes on their income is incorrect. A publication describing in question and answer format the federal tax rules that apply to group rulings of exemption under Internal Revenue Code section 501. First of all the answer is no churches do not pay taxes.

Income Tax Purposes. 1 Best answer. Organizations are generally exempt from income tax and receive other favorable treatment under the tax law.

See Publication 517 Social Security and Other Information for Members of the Clergy and Religious Workers for limited exceptions from self-employment tax. Prep File Your Own Taxes with Fast User-Friendly Software 100 Free. They are considered a common law employee of the church so although they do receive a W2 their.

The Best Tax Software For Clergy Your Other Filing Options RELATED. You must file it by the due date of your tax return for the second tax year in which you have net self-employment earnings of at least 400. What this means is that churches do not pay corporate taxes.

But this rule does not limit your deductions for home mortgage interest or real estate taxes on your home. Pastors fall under the clergy rules. This makes them independent contractors.

Ad Get Your Taxes Done Right Anytime From Anywhere. For more information on ministerial income check. All pastors are thought self-useful for social security purposes and for that reason pays a self-employmenttax of 15.

File With Confidence Today. Ad Federal Tax Filing is Always Free for Everyone. Do Pastors Really Have to Pay 153 for SECA.

With the 2018 tax changes the standard deduction is up by between 150 and 300 depending on filing status. John Schmidt received 50000 in ministerial.

Minister S Housing Parsonage Or Housing Allowance Servant Solutions

How Will A Biden Presidency Affect Taxes For Pastors The Pastor S Wallet

The Pastor S Guide To Taxes And The Irs Ascension Cpa

If They Re So Interested In Getting Into Politics And Telling Us How To Live Our Lives Let Them Pay Taxes Like The Rest Of Us Fix It Jesus Pastor Politics

Clergy Tax Guide Howstuffworks

Tax Prep Do You Know If You Have A Tax Lien On Your Property How To Find Out Tax Help Tax Prep

Tax Preparation For Pastors And Clergy Tax Preparation Our Services

How Pastors Pay Federal Taxes The Pastor S Wallet

Worth S Income Tax Guide For Ministers 2020 Edition For Preparing 2019 Tax Returns Paperback Walmart Com Tax Guide Tax Return Income Tax

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

Video Q A Do Pastors Really Have To Pay 15 3 For Seca The Pastor S Wallet